EU VAT Rules applicable since 2015

General Info

From January 1st, 2015, telecommunications, broadcasting and electronic services are always taxed in the country where the customer belongs* – regardless of whether the customer is a business or consumer – and regardless of whether the supplier is based in the EU or outside.

* For a business (taxable person) = either the country where it is registered or the country where it has fixed premises receiving the service.

* For a consumer (non-taxable person) = the country where they are registered, have their permanent address or usually live.

Implementation details

VAT Applicability

Below table summarizes how we apply VAT, depending on transaction participants and their location

| Transaction participants | Seller country | Buyer country | VAT | Notes |

| C2C Consumer to Consumer | EU | EU | No VAT mention | |

| EU | non-EU | No VAT mention | ||

| non-EU | EU | No VAT mention | ||

| non-EU | non-EU | No VAT mention | ||

| B2B Business to Business | EU (country A) | EU (country B) | No VAT (RC) | Customer must account for the tax (reverse-charge mechanism) |

| EU (country A) | EU (country A) | VAT | Same country | |

| EU | non-EU | No VAT | ||

| non-EU | EU | No VAT (RC) | Customer must account for the tax (reverse-charge mechanism) | |

| non-EU | non-EU | No VAT | ||

| B2C Business to Consumer | EU | EU | VAT | |

| EU | non-EU | No VAT | ||

| non-EU | EU | VAT | ||

| non-EU | non-EU | No VAT |

VAT Calculation and Vendor Type

Vat calculation depends on the vendor account type, which is either Private or Company:

- Private - VAT is not applicable

- Company - VAT is applied to all prices.

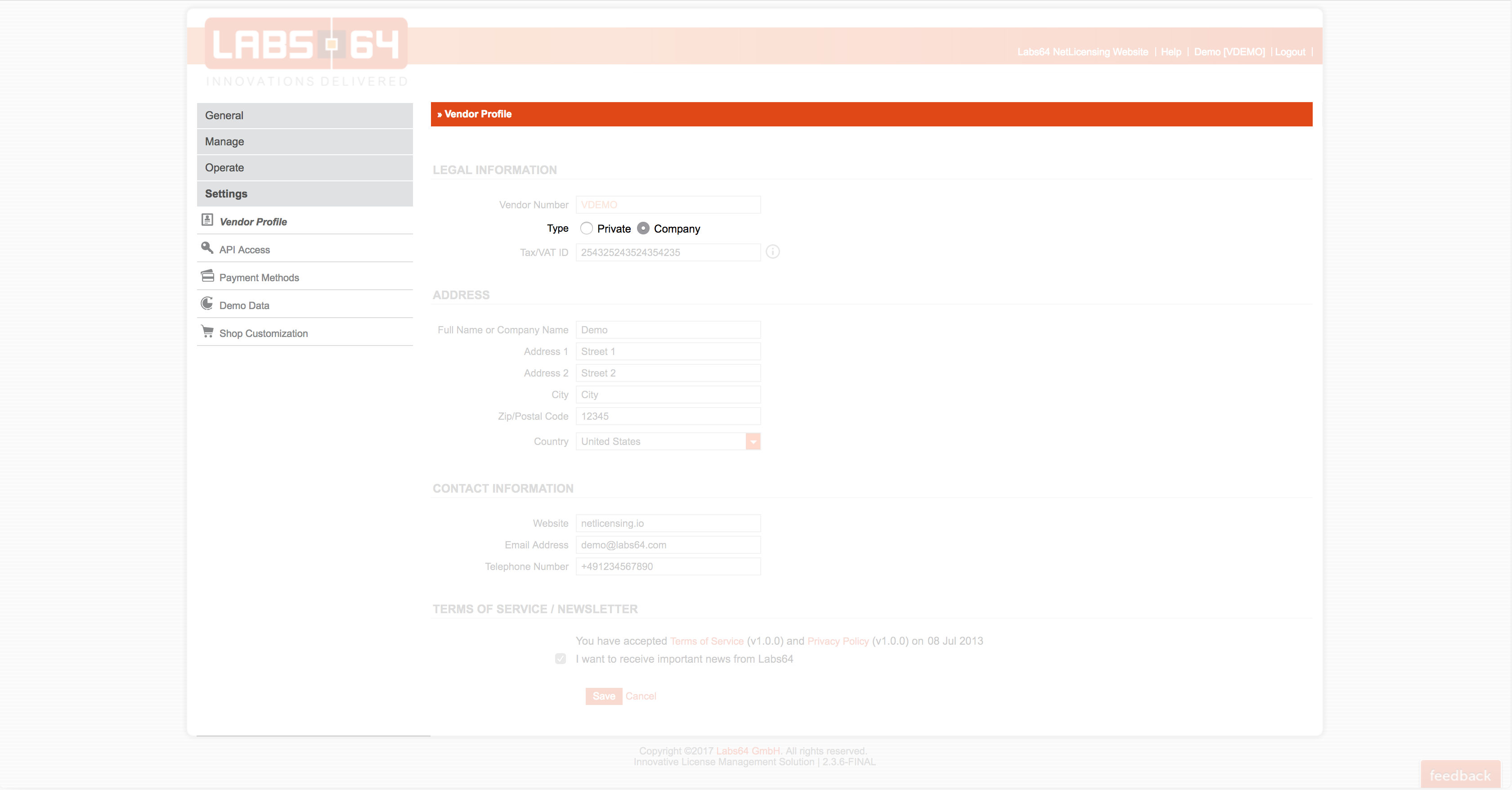

Vendor type is managed in the Vendor Profile section of the NetLicensing Console:

VAT Calculation and Product

For each product you can choose one of the two Vat Calculation Modes:

-

Gross: VAT is already included in the specified price*

-

Net: VAT is not included in the specified price

* Gross mode is default for all new products and products created prior to introduction of VAT handling.

![]() Vat Calculation Mode options may not be available in your pricing plan!

Vat Calculation Mode options may not be available in your pricing plan!

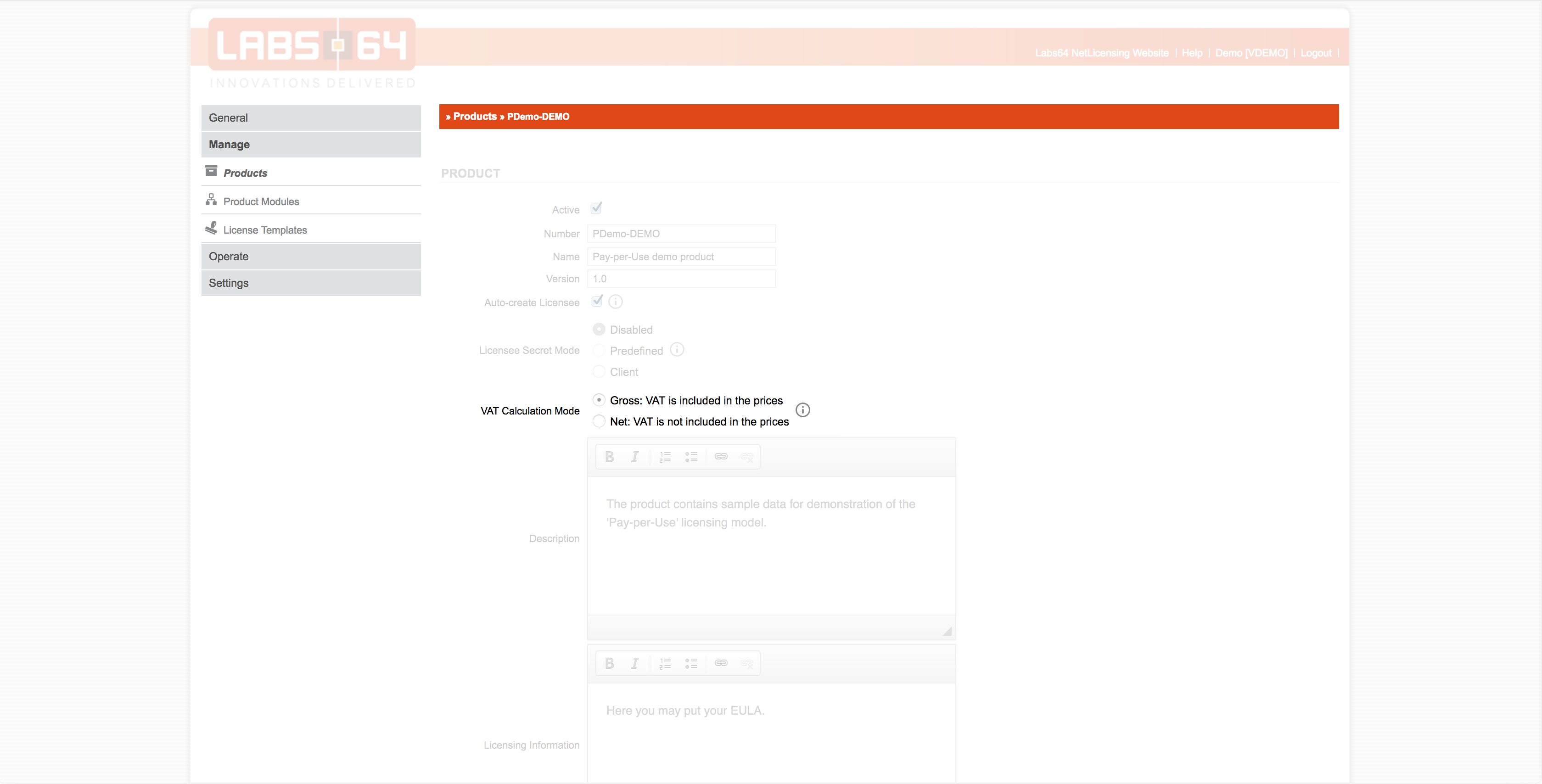

Vat Calculation Mode is managed via the Product Edit in the NetLicensing Console:

Shop and VAT Calculation Mode

-

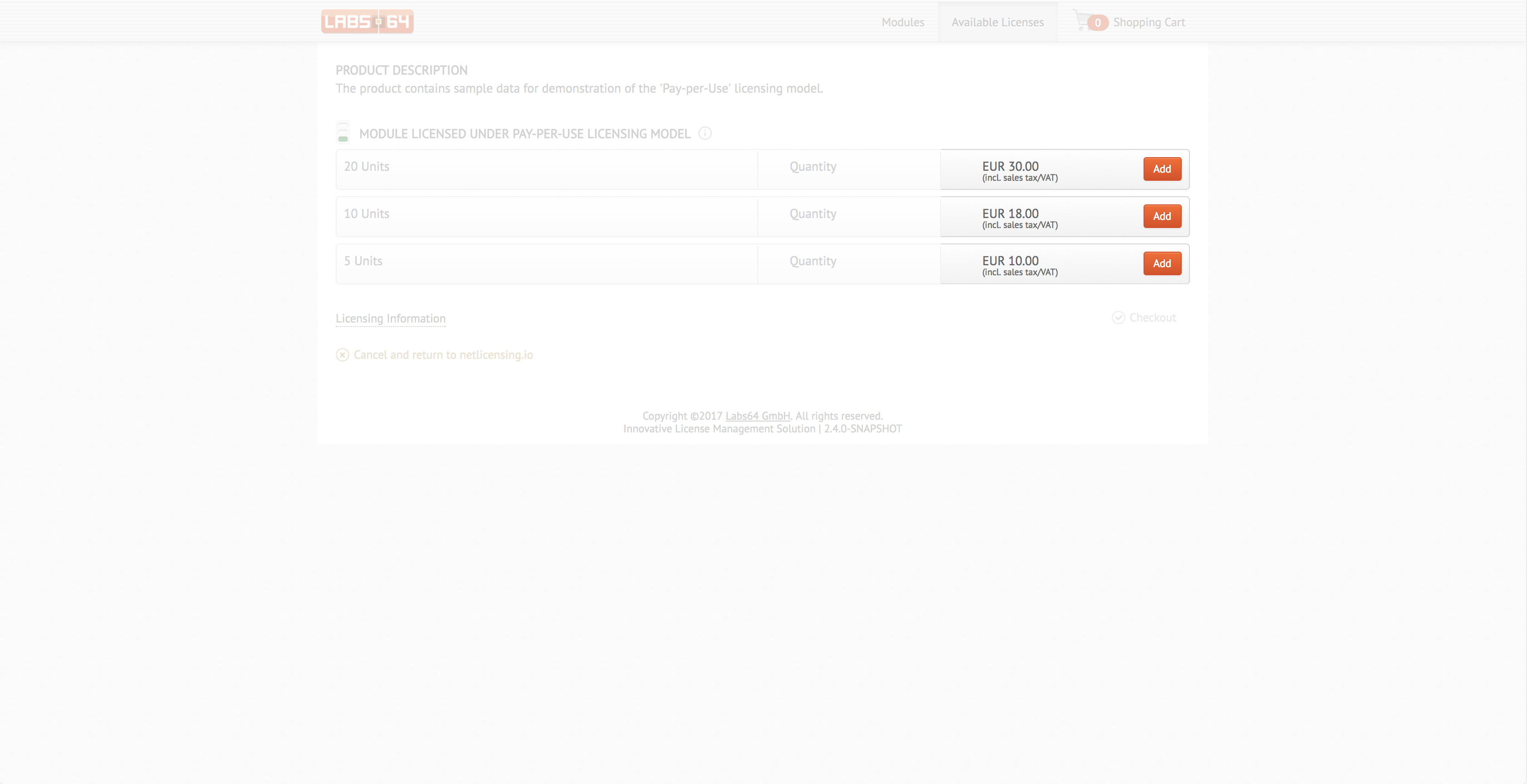

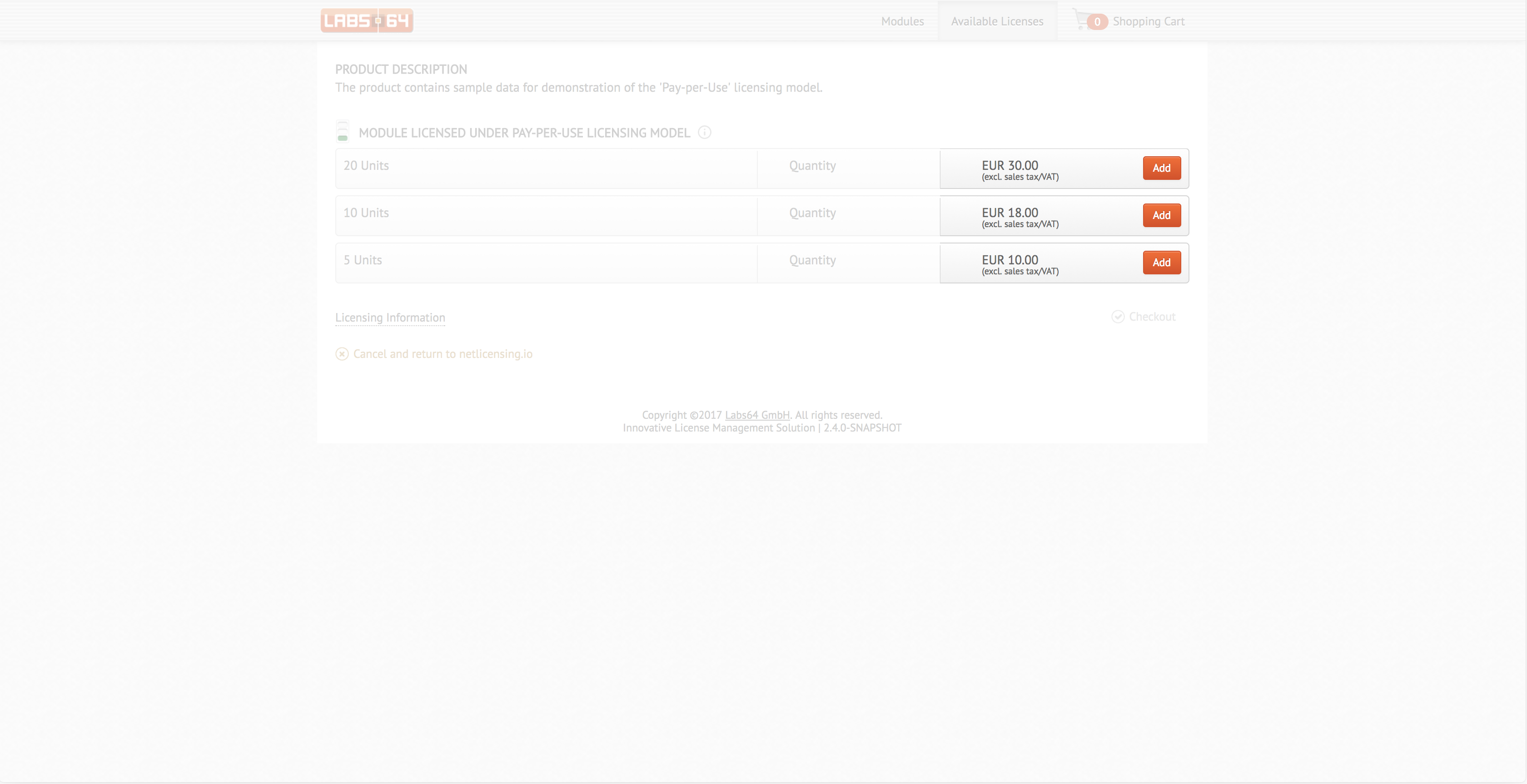

Gross calculation mode implies that the VAT is already included in the specified price, which is reflected in the NetLicensing Shop as a corresponding note below the shown prices:

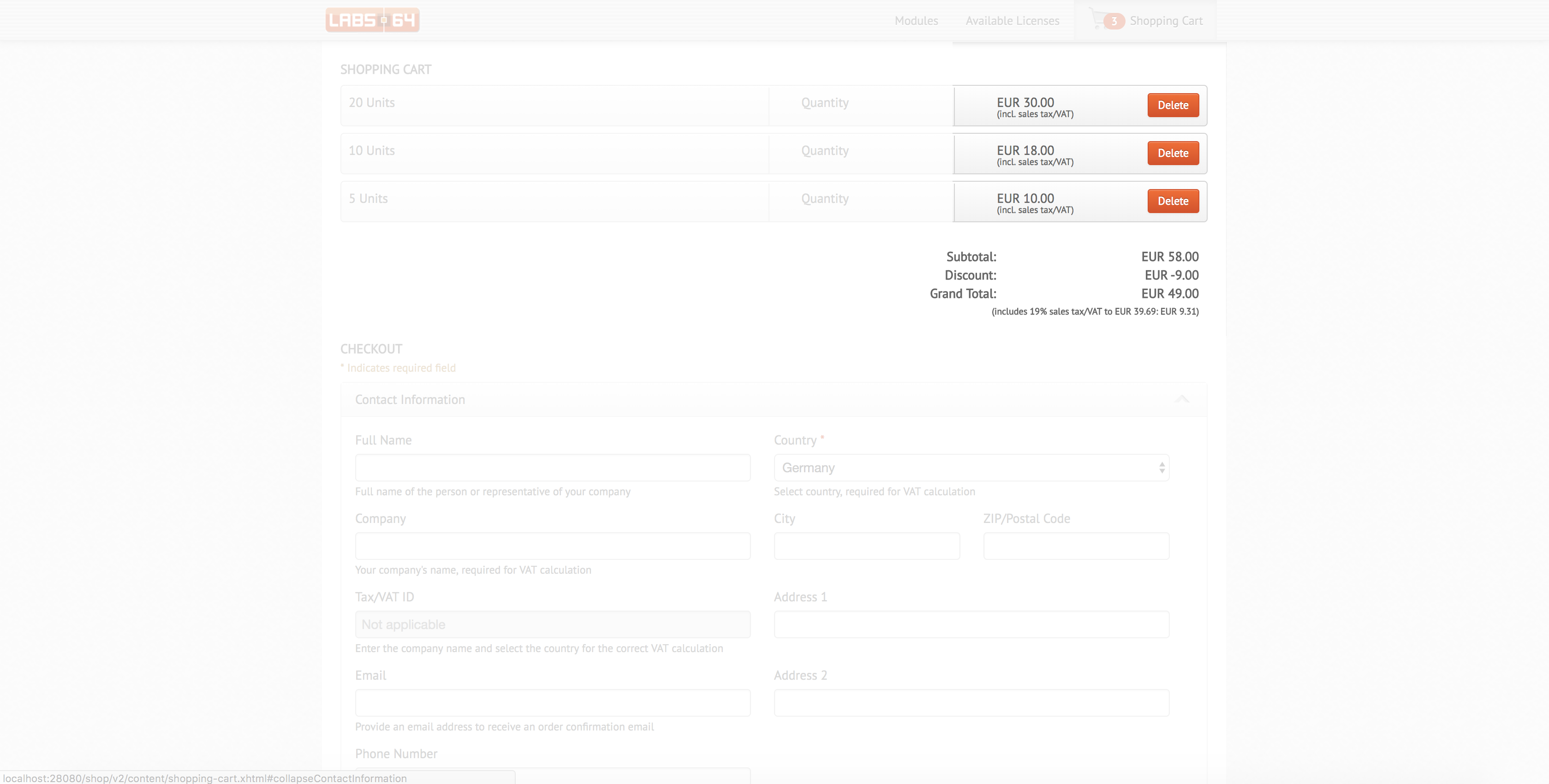

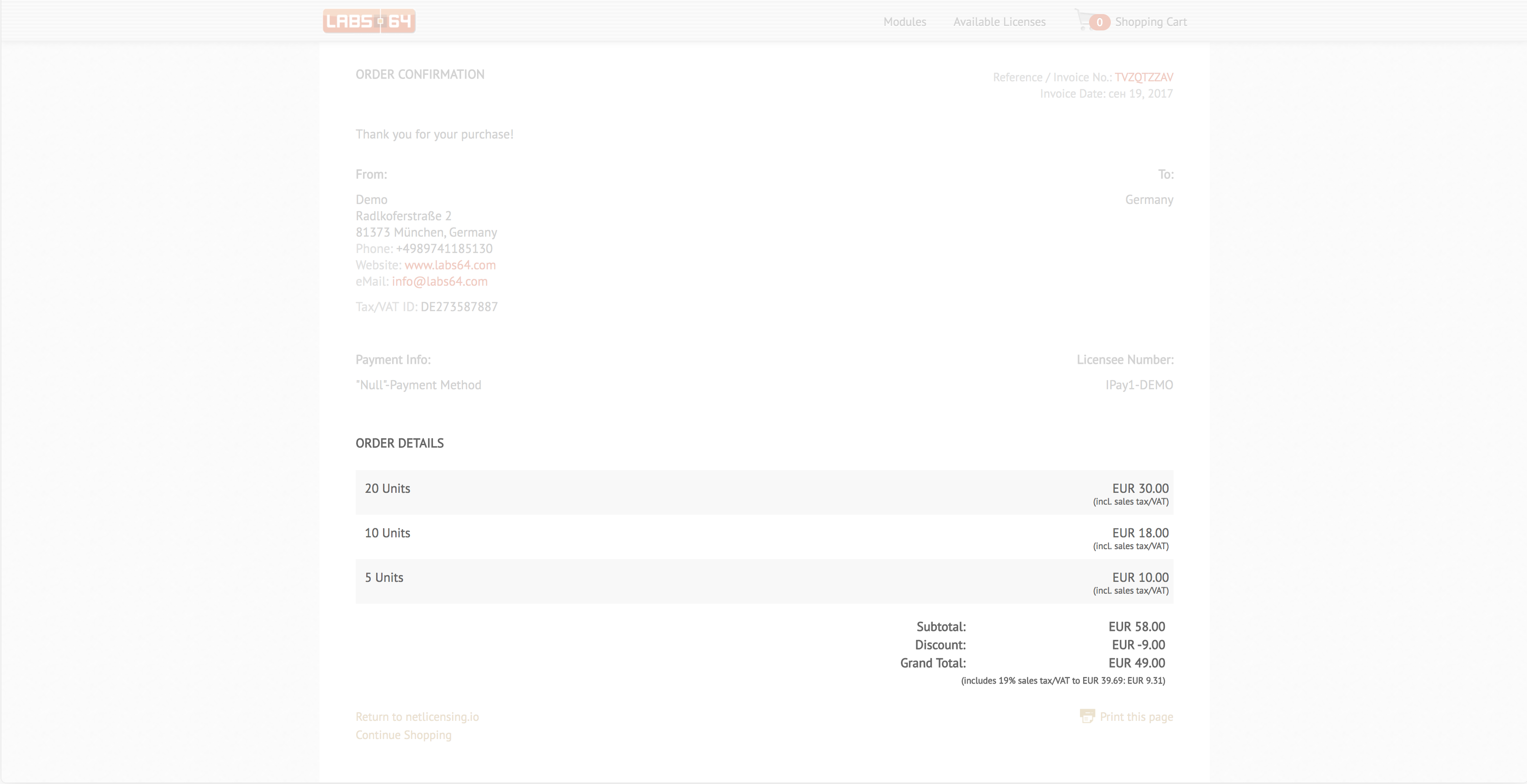

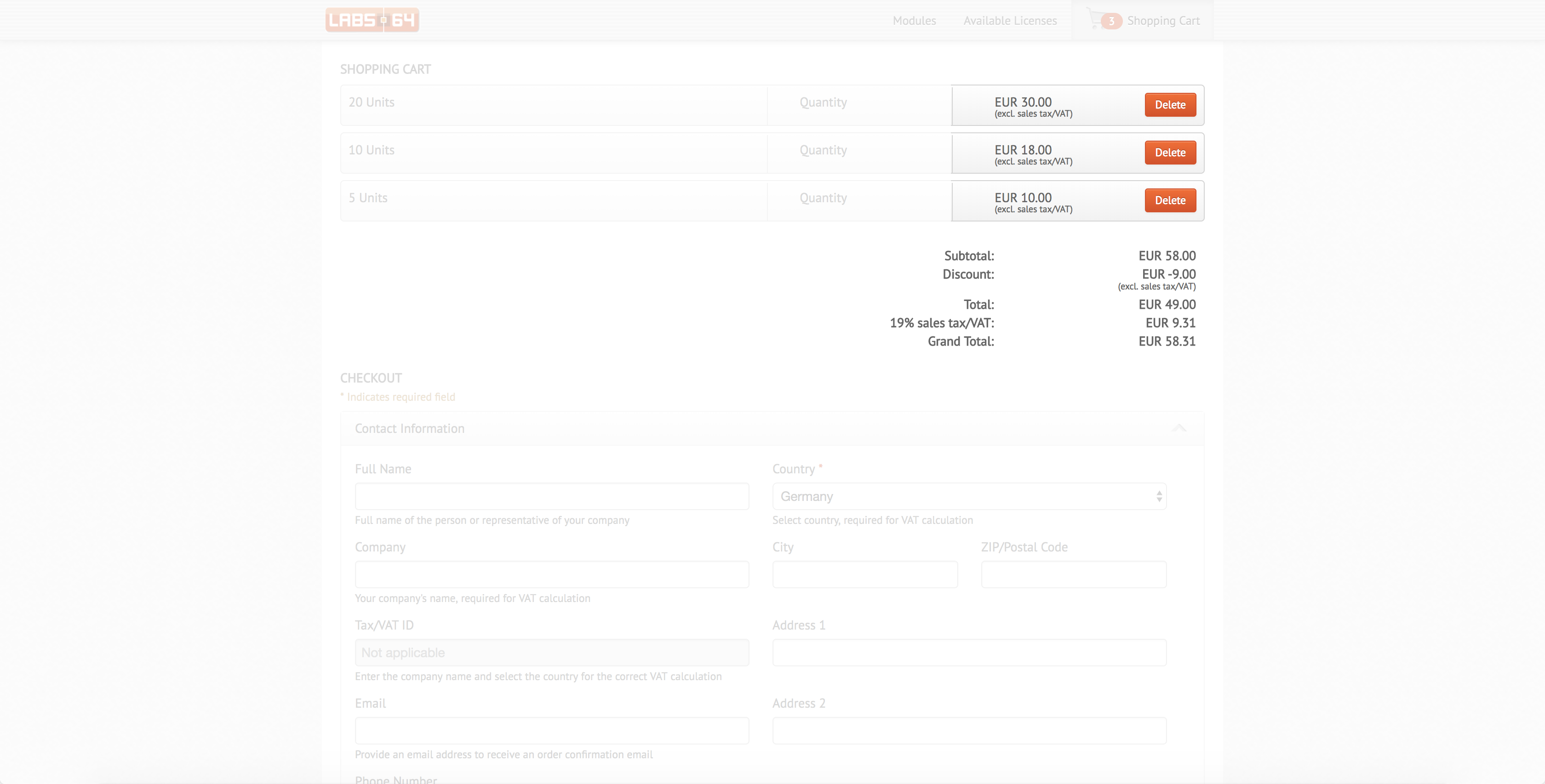

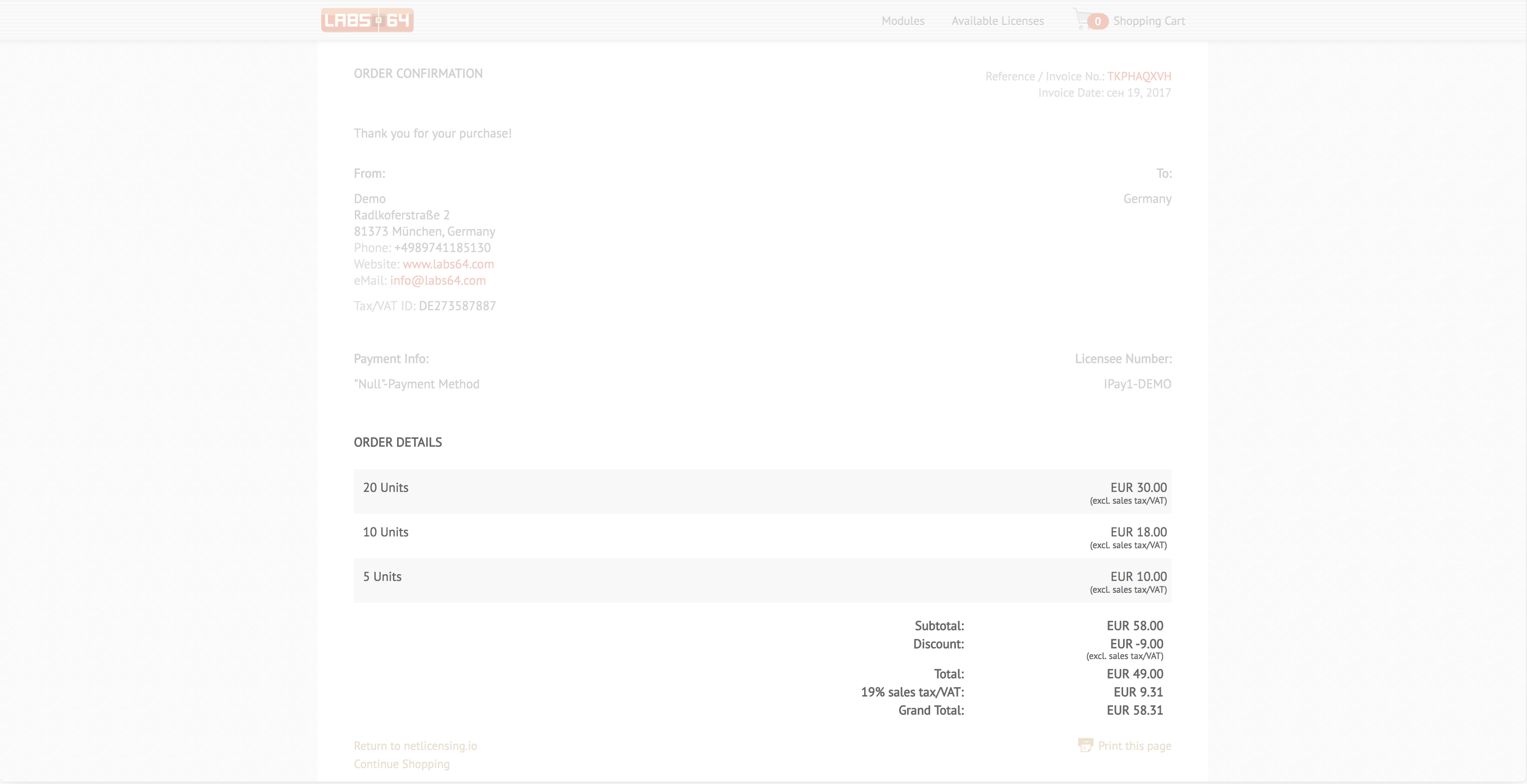

And VAT percentage and actual calculated amount shown on the checkout page as well as order confirmation:

-

Net calculation mode implies that the VAT is not included in the specified price and must be added on top of it, if necessary. Accordingly, NetLicensing Shop adds a note below the shown prices:

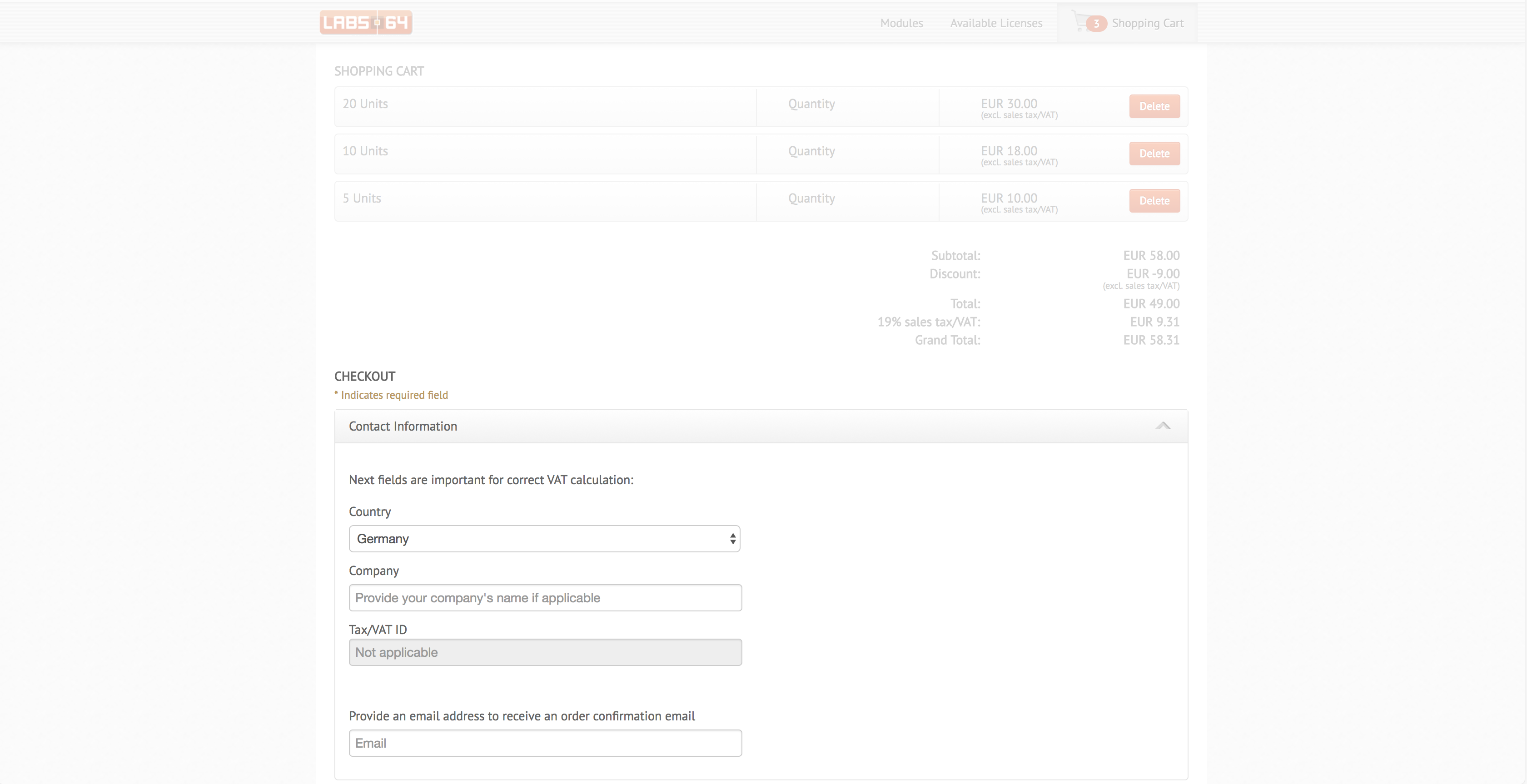

Shopping cart view and confirmation page shows calculated VAT as a separate field:

Changes to the Checkout Flow

Checkout page includes new fields, required for the correct VAT calculation:

- Country

- Company

- Tax/VAT ID